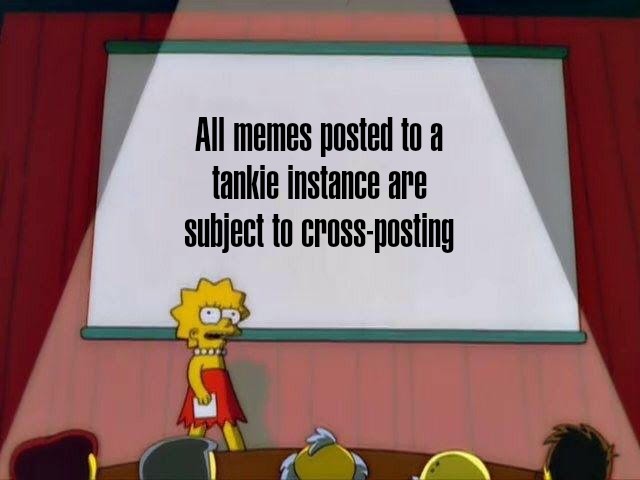

- cross-posted to:

- memes@lemmy.ml

- cross-posted to:

- memes@lemmy.ml

“You think you’re better than me? You’re not! You’ve all reposted my drool memes!”

I don’t know what’s sadder: Dominoe’s offering to pay pizza over 6 weeks; people being so poor that they have to pay a pizza over 6 weeks; or people being so dumb that they still buy pizza that they have to pay over 6 weeks when they have no money.

As for the latter, sometimes you have no other options, so you do things that you know are financially bad decisions because otherwise you starve. When I was younger I’d knowingly write bad checks at the grocery store because I needed food and couldn’t get it any other way. I’d have a paycheck coming in a few days, and knew I’d have to pay the fee, but it was that or starve. That’s not an option these days, since they verify checks immediately now.

Only pizza is not a basic foodstuff.

Did you not understand the part that they probably don’t have other options? You can’t bounce a check at a grocery store anymore, and grocery stores don’t offer financing.

Por qué no los tres?

Yes.

My ex signed up for food stamps at one point. But she had new boots and plenty of weed to smoke.

Don’t ever criticize people who accept welfare. They are not the problem.

I already did and I will continue to do so. They prioritized purchasing weed and designer boots instead of buying groceries for themselves. That welfare money was for people that are actually struggling and not just pissing away their money without any consideration for the future.

I realize I’m coming off as a class traitor. But you have no idea what the actual situation looked like.

If she can’t afford footwear, weed, and food, then she is struggling. These are not lavish purchases. Did you know that corporations are the largest recipients of welfare in the country? We’re talking billions of dollars more than personal welfare payments.

Buying close to $1,000 in footwear when all your other footwear is 100% functional and then realizing you need stamps to buy food is a problem.

Yeah, that’s problematic spending. How did she qualify for food stamps if her income was high enough to have $1000 to spend on boots? At one point in my life I was upside down after paying rent, insurance, utilities, and car payment, and was still told I had too much money when I applied for food stamps. I was literally upside down with negative dollars in my bank account, no job & no prospects due to recession, on unemployment, and the State said I had too much money.

This makes no sense, how can you have 1k to buy boots, but still have a low enough income to qualify for food stamps?

And you realize food stamps isn’t something you can just get on when you realize you overspent that month, it’s a months long process in many places with paperwork and income verification.

You sound like someone whos never had to deal with the welfare process at all and spout bullshit to discredit it like many right wing nuts like to do.

Shes probably your ex because she broke up with you, good for her.

Yes I realize it takes a long time to get approval. The paperwork started showing up at our house while she was doing that spending. My entire point was that she was abusing a welfare program.

She wouldn’t have qualified for SNAP if she wasn’t among the intended recipients. What she spends her money on is not what is used to determine eligibility.

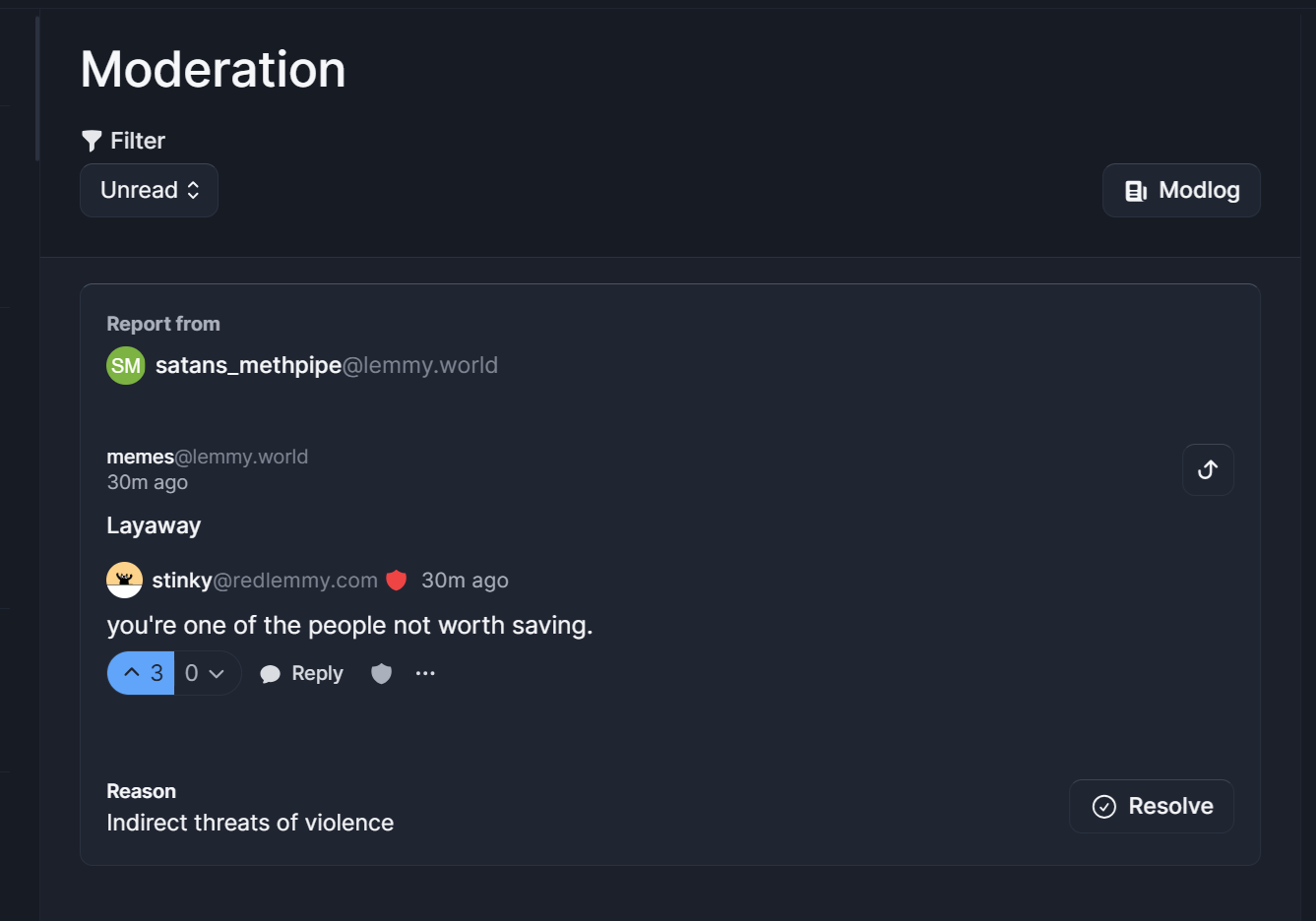

you’re one of the people not worth saving.

What do I need saving from? It kind of seems like you’re threatening me with violence.

You just reported me to myself, dumbshit.

Don’t reports on Lemmy get sent to the mods, the instance admin and the user being reported?

Then put yourself in time out kiddo

Far out these downvotes and comments. Some of these people need to grow up/have more birthdays and/or get a lesson in reading comprehension. If someone can afford designer boots and weed but won’t buy groceries they have made a choice & they are taking advantage of the welfare system. When they do, the people in charge of the welfare system see this and tighten the purse strings and make it so that people who actually need it begin to suffer and miss out.

That’s not how it works or how it is meant to work. Food assistance is provided based on income, not on whether or not you have the ability to save up for a nice pair of shoes. And, in fact, it is intended to help you be able to do so. All of your money shouldn’t have to go to food.

Eugh. With the downvotes, really? How naive are people? Yep, I understand what you’re saying. And that’s usually how it works. But f# me if it doesn’t work like that a lot of the time. And my point is (and I think what the other person who started this chain means) that when people who could have enough and not take advantage of the welfare system (like many many people do where I live) do take advantage, the hammer comes down and less fortunate people miss out.

Even if this story is 100% true I honestly have zero problem with it. The money you make from working should be for fun stuff like really fancy shoes, not mandatory labor for survival.

I don’t know about the US, but in Europe Domino’s is ridiculously overpriced. Like, if you got a 50% off coupon, you are approaching normal pizza prices. And it’s not even that good.

Yea, that’s a common thing with American fast food joints overseas IME. Whenever I’ve gone to another country and visited the local McDs or whatever it’s always so expensive compared to the states.

Here dominos with coupon is often the cheapest around, not the greatest, but decent enough especially with one of those 50% off coupons

McDonalds seems to have become an exception, as it tends to be cheaper in the EU than in the US

Straight up, dominoes has the cheapest pizza deals of any pizza chain in the state in my area. Not by a lot. Their quality is like C-tier, but I don’t give a shit, it’s pizza, it’s still decent.

I can get a large three topping pizza for $8 USD compared to $10 at Pizza Hut or $11 at Papa John’s.

They’re perfectly low-cost for some mid pizza but state-side.

I can get a large three topping pizza for $8 USD compared to $10 at Pizza Hut or $11 at Papa John’s.

Do you only have chains? No normal pizzeria?

Nah, I live in an area with lots of older Italian immigrant families actually, there’s a few pizza shops, sandwich shops, and import markets that have way better pizza.

Domino’s is when I’m being a lazy fat piece of shit and grabbing cheapo garbage on my way home from work or something. Rittino’s has way better food, but their large pizza costs $25

Lol, a normal sized three topping pizza here in Germany at Papa Johns is like 17$. Domino’s is not better with ~15-16$ though.

MFW, Chicago pizza prices are higher than Germany and people are saying Europe has the most expensive pizzas, while other Americans are paying less than $10 for a pie.

I remember having one in Norway, where the location was at a waterfront. Their dough tasted like it was bathed in saltwater 🤮

It’s the same in Japan! Smallest pizza you can imagine at 3-5x the price

Almost all the fast food ive had in europe (France, Spain, UK, Italy, Germany etc…). was better than here (Canada), except for Domino’s. It’s always bad pizza and really overpriced.

Here it’s not the best pizza, but super consistent and the cheapest around with those coupons.

Huh, Domino’s in my area has a perpetual coupon for $7 2 topping pizzas if you buy two.

Dominoes in the US is terrible. Is their quality better outside the US? Otherwise I don’t see how they could compete charging twice as much as other pizza places.

Awful in Australia.

They got a fancy menu but it still all smells of old oil or something.Based on my sample size of the one Dominoes restaurant in Nijmegen (Netherlands): it is better outside of the US. Still not great, but better. The chicken shoarma pizza could possibly be considered ‘good’ if it were fresh, but that location only does delivery so…

I don’t think most people in the US would know what chicken shwarma is. The concept sounds good but I’m sure dominoes would find a way to fuck it up.

The company I work for (in e-commerce) just recently started offering/advertising paying using Klarna.

If you don’t know, (and you can probably guess given the context of this post), Klarna is a company that basically just allows users to buy now and pay over the course of a few weeks. “Buy this $100 item now and pay in four installments of $25 over four weeks” or some such. Anyone can get the app and it gives credit card numbers that will buy stuff online or whatever, and then the paying back process is that Klarna bills the customer over the course of a few weeks.

But companies can integrate with Klarna as well. When they do, Klarna makes everything work like it does with credit cards so the company doesn’t have to completely retool to support Klarna as a payment method. And it’s more convenient for the customer than dealing with the app and manually typing in the credit card number they get from the app.

Here’s the thing, though. There’s no interest charged to the customer. I think Klarna makes its money just because companies pay them money for integrations and for the ability to advertise that customers can buy now pay later and such. And at least in the case of my company’s integration with Klarna, Klarna takes all the risk. They’re lending customers money and hoping the customers pay it back. My employer gets the money up front and isn’t out any money if the customer doesn’t pay. And Klarna is huge. They’re holding a whole lot of debt at any one time. And it’s not secured debt or anything. And I don’t think there are credit checks involved.

Really seems like a risky thing. Just like risky mortgages are. If a significant number of customers were to default on their debt at the same time (and not all Klarna purchases are $6 pizzas, some are multiple hundreds of dollars worth of debt), I’d imagine Klarna would be out of business quicker than Enron. Or maybe they’ll be “too big to fail” by that point and they’ll get a bailout.

Either way, it seems like a not-insignificant chunk of the economy is teetering atop the pencil-balanced-on-its-point that is Klarna. I’m not sure if there are a lot of other companies offering similar services, but if so, that just makes the economy seem that much more precarious.

This reminds me of PayPal from 25ish years ago. There wasn’t a convenient way to transfer money online and they built a solution. To achieve critical mass, they offered people $10 to sign up and a $10 referral bonus (if your friend get $10 and you get $10). PayPal burned a lot of investor money to do this, but it paid off when they became the dominant payment method for eBay auctions. In short, it was a costly investment that paid off.

Klarna is trying to become the PayPal of e-commerce, displacing credit cards (and PayPal) and becoming the default means of paying online. Once they start to slow in their growth, they can do the following:

- Charge merchant fees.

- Charge service fees.

- Charge interest, (waiving it for debit-like transactions).

- Offer purchaser subscriptions with enhanced features and reduced costs.

- Push exclusivity agreements by offering discounts against steep fees.

- Sell data.

This last point is particularly powerful because they also have the bill of sale, which most payment options don’t. If they offer point-of-sale systems that also collect detailed data, it would further allow them to track people.

I suspect that they are classified in a way that existing restrictions on payment networks do not apply to them. E.g., they may technically be a lending company but act as a payment network; they may be considered the customer in a transaction, that resells the item to the purchaser, etc. Lending companies aren’t expected to work with the copious amounts of detailed data that stores and payment processors do (e.g., Payday Loan doesn’t know I spent part of my loan on a suitcase of Bud Light). Imagine an insurance company knowing how many drinks your table bought at a restaurant, then holding it against you when you make a claim. Or having a job offer revoked because you bought a copy of the Communist Manifesto to see what all the hubbub is about.

Sounds to me like they’re waiting for people to get used to this model for every purchase before they quietly add interest.

ikr this is literally step 1 of enshittification.

deleted by creator

Reminds me of something I heard back in 'zine times. “The trick is not to ignore the mainstream, but to selectively raid it for things we can use.” -Mike Gunderloy. The resources are there, so go ahead and use them – just do it on your own terms, consciously. I don’t have Amazon Prime, but when my elderly relative needed a safety device and I could only find it on Amazon, you bet I got it from there.

I use affirm pretty often and usually there are options where you extend the term a few months but add interest. Haven’t paid interest cause I have that luxury but being able to extend large purchases over 2-3 months without interest is amazing.

They make money from people’s mistakes and/or desperate situations.

As in: if a customer doesn’t pay one of the payments exactly on time they turn into loan sharks with “penalties” vastly exceeding the loan price.

They’re not “hoping the customers pay it back”, it’s almost the opposite - they want people to miss a payment or two and end up paying way more than the actual loan.

This is how they make money. It’s the only way they make money. The Maths of their business model don’t work out if people don’t make mistakes and thus don’t end up paying penalties.

So they have a huge incentive to do everything they can to make it easy to get into their scheme (hence they treat sellers well so that going through them as a payment option is as seamless as possible), to make it more likely that customers make mistakes and to make it hard or even impossible for customers to leave that scheme without going through the full minefield: they’re basically enshittifying the seller’s website, making it similar to providers with subscriptions who make it hard for people to cancel those subscriptions.

It’s really not worth it to get into that shit as a customer and, if people who get stung by those practices also blame the seller, it’s probably not also not worth it for a seller selling low value items as it might add but a handful of sales from the few customers that do need a loan for that, whilst damaging their own brand name by being associated with what are basically modern loan sharks.

This is how they make money. It’s the only way they make money.

That is not correct. Klarna is functionally a payment processor, like an advanced type of credit card, and charges the merchant fees per transaction. For example, see here. They are highly cagey about specific fees until you actually sign up, and it depends on region and business size. But interchange fees are where the majority of their revenue comes from. To my knowledge, the fees are typically 3 percentage points above what the merchant would pay for a credit card transaction.

The reason merchants still accept Klarna despite the high fees is of course, improved conversion rates and decreased risk. Klarna assumes all the risk of the customer not paying, the shop gets all of the money instantly and doesn’t have to worry about it for the most part. That mainly makes it attractive for high margin shops that don’t mind spending lots on marketing to get a few extra sales (fashion, perfume, high end electronics).

I’m not too knowledgeable on how Klarna deals with late fees, but I’m pretty sure it differs per country they operate in. Many places have regulations limiting the abuse of late fees. I wouldn’t be surprised if the US is not that kind of place, and people who are late get fucked with fees.

In general, I agree with the second part of your comment and I do not recommend using any buy-now-pay-later kind of scheme, because you’re taking on additional risk for no real reason. Lots of stuff can happen even through no fault of your own (check engine light? Job downsizing?) that will affect your expected future income.

Yeah, you’re right,

I forgot that when I read about it, it was also mentioned they got payment processor fees.

As for the way they handle late fees, the article I read was about the US (somebody posted an article about it here in Lemmy not that long ago) and indeed some other countries limit that sort of thing in general, so it should apply the same to this kind of operation.

Luckily, it seems government are finally getting their acts together to regulate these schemes: https://www.choice.com.au/money/credit-cards-and-loans/personal-loans/articles/bnpl-legislation-passes-parliament

Which means they need to register as credit providers, which is what they are…

Oh it’s well hidden in the details, but the interest gets paid. In fact, if you miss a single payment, you pay everyones interest. And they will absolutely come after you for an originally tiny amount of money.

That company and business model is shaddy as hell, although I’ve met some engineers some years ago that seemed pretty competent, but I’ve suffered and learned enough over the years to know that it doesn’t matter if the c-level ppl is all bullshit.

Here’s the thing, though. There’s no interest charged to the customer. I think Klarna makes its money just because companies pay them money for integrations and for the ability to advertise that customers can buy now pay later and such. And at least in the case of my company’s integration with Klarna, Klarna takes all the risk. They’re lending customers money and hoping the customers pay it back. My employer gets the money up front and isn’t out any money if the customer doesn’t pay.

Your company pays a transaction fee just like with a credit card. Except it’s usually roughly twice as expensive as a credit card. This is what allows Klarna to take on all that risk, generally. For your company this is essentially a marketing expense. Offer a convenient way to pay in return for a few percent of the transaction (3-6% + a fixed fee, $0.30 perhaps).

Klarna generally partners with some financial firm to finance these short term loans, and they use the merchant fee to pay interest. These can be as high as 25% APR. It’s a high risk loan.

I typically use Zip, which is the exact same thing, I don’t tend to rail against it like most Lemmy seems to do. Maybe they make things a little too easy for those who are terrible with regular credit cards and debt management to begin with, but many around here equate them to loan sharks and Paycheck Lending/Car Title Loans type places and those are absolutely predatory as fuck. Klarna and Zip aren’t even close, they’re closer to credit cards if anything.

Since there’s no interest (on zip there is a 4$ flat fee per order though, dunno if klarna does the same), it’s basically just the classic saving up for what you want, but you get the item right away.

Say you wanted to buy a $100 item, you have the income to save for it 25$ every 2 weeks but not to take the entire load at once, Zip would be the same as saving 25$ every 2 weeks on your paydays, except you get the item right away. And unlike real predatory loan places, like you said it’s all unsecured so if you default on it, eh oh well.

The fatal flaw with this is, I will want another pizza inside of six weeks. Can I put a double mortgage on the first pizza to pay for the second pizza?

Could be risky - you don’t want to end up upside-down on your pizza mortgage

I want to be upside down under Luigi

I think you want a different chain, this is Papa John’s, not Daddy Luigi’s

the only chain I want is

.

.

actually this joke is getting tired just kill ceos

This is the second time in the same thread I’ve seen someone write “upside down” to (I assume) mean “insolvent” despite never seeing the phrase before in my life. Y’all all from the same town?

I think it means “owes more than the value of the collateral”, so even liquidating the collateral to pay off the debt will leave you with residual debt. I’ve usually heard it called “underwater on the loan”.

Sounds like somebody isn’t making the most out of their weekly slice…

Why is the pizza in prison

Papa John is technically a pizza crime.

wait, is this real life? are we financing shitty pizza now?

Fintechs are trying to get their grubby little claws into everyone who’s desperate or stupid enough, so wouldn’t surprise me at all if BNPL* companies are doing deals with takeaway places.

I genuinely pity anyone using this because they need to. 😬

*Not sure about elsewhere, but in the UK this legal predatory practice is called Buy Now Pay Later. Online loan sharking without the broken kneecaps.

I can’t not hear “the greatest technician that’s ever lived” after seeing this

This isn’t really relevant, other than to establish you have to be one broke bastard to need a pizza layaway, but Papa John’s offers a carry out special large one topping for $9.99 in my area.

They also offer a large one topping for $8.99. Same exact pizza. No limitations.

Shaq’s really putting that Purdue University degree to work I guess.